Employment Opportunity: Heartland Is Hiring an Asset/Portfolio Manager

03.11.2019

Heartland is currently seeking candidates for a full time Asset/Portfolio Manager. (FLSA Status: Exempt)

Position Summary- Heartland recently merged with Laird Norton Properties (“LNP”), the real estate entity of a seven generation, Seattle-based family enterprise, and took on asset management responsibilities for LNP’s office portfolio in Seattle, Denver, Portland and Salt Lake City. The Asset/Portfolio Manager is responsible for implementing strategy and overseeing the performance of the eight-asset office portfolio. The scope could evolve to include new direct investments.

The Asset/Portfolio Manager will proactively monitor and respond to shifts in the markets and within the LNP strategy in order to ensure that each property and the portfolio as a whole produces its optimal risk-adjusted return throughout is investment lifecycle, utilizing the following strategies:

- Recognize and actively manage risks at all levels: tenant, property and portfolio.

- Conduct rigorous financial analysis to support key activities including, leasing, capex, disposition and capital decisions.

- Assemble and manage best-in-class property management and leasing teams.

Continually and thoughtfully update the investment thesis and business plan for each property in the context of the specific asset, the market and the LNP Portfolio

Firm Profile

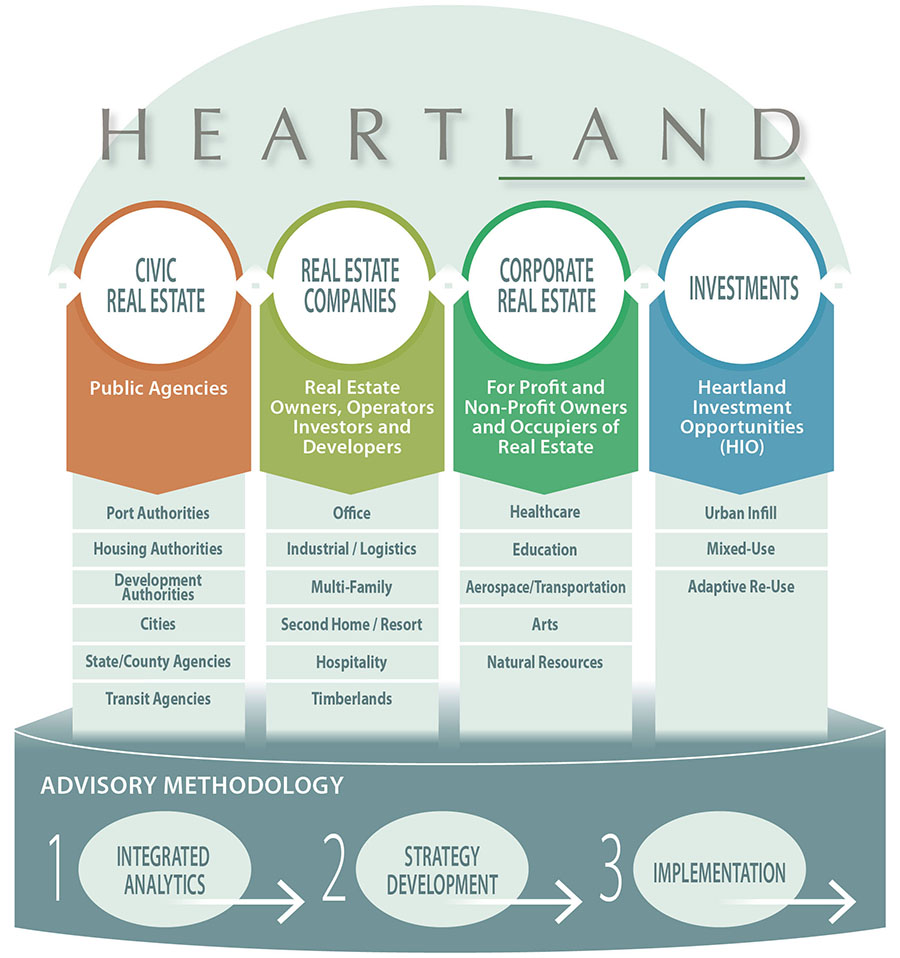

Heartland is a Seattle-based real estate advisory and investment firm with over 30 years of experience creating value for clients, including families and family-owned businesses, non-profit organizations, corporations, as well as real estate development, investment and operating companies. Heartland combines strategy development and analytical rigor with execution capabilities in real estate brokerage, asset management, capital markets, and development services to positively impact the communities, organizations and families with whom we work.

Our practice is rooted in a deep understanding of the fundamental drivers of real estate economics. With experience across both the public and private realm, we offer a unique ability to blend the needs of the private sector owner with public sector processes and initiatives. Additionally, the expertise derived from work on our own investments and developments enhances and leverages our ability to advise others in all aspects of real estate-related activities. Heartland is unique among real estate firms, both in terms of our breadth of capabilities and our long-term, relationship-based approach to collaboration with clients and investors. This breadth in services is key to our value equation. Our scope enables us to leverage knowledge from one business line in support of another as well as provide a robust continuum of real estate services tailored to a diverse client base. Click here for more information about what we do at Heartland.

Essential Duties & Responsibilities of Asset/Portfolio Manager

- Create and implement annual asset-level business plans, including but not limited to leasing strategy, capital improvement plan, etc.

- Oversee creation and implementation of operating budgets in coordination with third-party property management.

- Ensure compliance with all capital (debt and equity) and other legal documents related to the assets.

- Obtain and oversee insurance related to the assets and portfolio, in coordination with third-party insurance brokers and internal LNP team.

- Track market activity (values, rent, occupancy, absorption, sales trends) and economic trends and use it to inform asset and portfolio strategy.

- Perform valuations and site visits on a regular basis.

- Develop regular reporting tools to keep senior leadership, owner and investors updated.

- Perform range of financial and operating analysis.

- Assist internal accounting with financial performance reporting and maintain YARDI, SharePoint, and ARGUS.

- Anticipate, develop and recommend solutions addressing any performance issues. Execute approved solutions in coordination with property-level teams.

- Assist senior leadership in evaluating major decisions related to the assets (e.g. dispositions, major leases, major capital improvements, refinancing, etc.).

- Develop regular communication and information sharing protocols with third-party property-level partners (e.g. property management, leasing brokers, etc.)

As noted above, the position could evolve to assisting with the asset management of new investments. The essential duties and responsibilities would also evolve to reflect the broader portfolio, multiple platform relationships and potential third-party equity and debt reporting and communication.

Educational & Professional Experience Requirements

- 4-6 years of experience in commercial real estate asset management which includes: accounting, finance, underwriting, lease administration, landlord/tenant relations, and/or property management.

- Experience with urban and suburban office assets, urban multifamily assets and industrial assets is particularly useful.

- Experience in the Seattle, Portland, Salt Lake City, Denver is particularly useful.

- Minimum of a bachelor’s degree in finance, accounting or related subjects.

Key Skills & Competencies

All Asset/Portfolio Manager applicants should possess the following skills/knowledge:

- Broad understanding of real estate finance, performance metrics, valuations and different capital (debt and equity) structures

- Ability to perform cash flow analyses

- Strong accounting/financial background

- Real estate valuation fundamentals

- Abilities in market research and analysis

- Demonstrated technical writing ability

- Strong communication skills (written and oral) and ability to maintain effective documentation

- Quantitative analysis and financial modeling capabilities

- Strong team management skills, including managing internal teams and interdisciplinary external teams

- Consummate project management capabilities process, timeline and deliverable management

- Quantitative analysis and financial modeling capabilities

- Strong analytical skills

- Strong organizational skills, time management and attention to detail required

- Strong writing, presentation and interpersonal skill

For all applicants, demonstrated advance knowledge with the following software is required:

Argus

Yardi

Microsoft programs (Excel, Word, PowerPoint)

Ideal Candidate Qualities

Our ideal candidate(s) will have a strong compatibility with Heartland culture in terms of intellectual curiosity, team-oriented nature, problem-solving capacity, desire to learn new skills as projects demand, a focus on high-quality work product, and ability to work in a fluid, fast-paced environment.

- Proactive self-starter with ability to follow directions and also set own action plan

- Ability to learn and adapt quickly

- Ability to manage multiple tasks and meet delivery deadlines

- Ability to work effectively both independently and within teams

- Ability to probe, ask the right questions, and dig beneath the surface to test the validity of information

- Ability to think critically, solve problems and make well-reasoned business decisions

- Outstanding critical thinking capacity

- Interdisciplinary capabilities

- Desire to work with clients

- Superior attention to detail

- Ability to focus on a variety of tasks simultaneously

- Strong self motivation

- Team orientation

- Flexibility

Reporting, Supervisory & Collaborative Responsibilities

- Reports to a Heartland Partner

- Manages property-level teams, including third-party property managers, leasing brokers, etc.

- Collaborates with internal project teams

- Collaborates with internal accounting team

Other

Travel required to appropriately cover the assets and the market.

Compensation

Market appropriate; experience and skills considered, comprehensive benefits package included.

Application Process

Applications accepted on rolling basis

Applications shall include the following:

Cover Letter

Résumé

Applications should be sent via email to:

Carrie Christensen, Project Administrator/Marketing Coordinator

cchristensen@htland.com